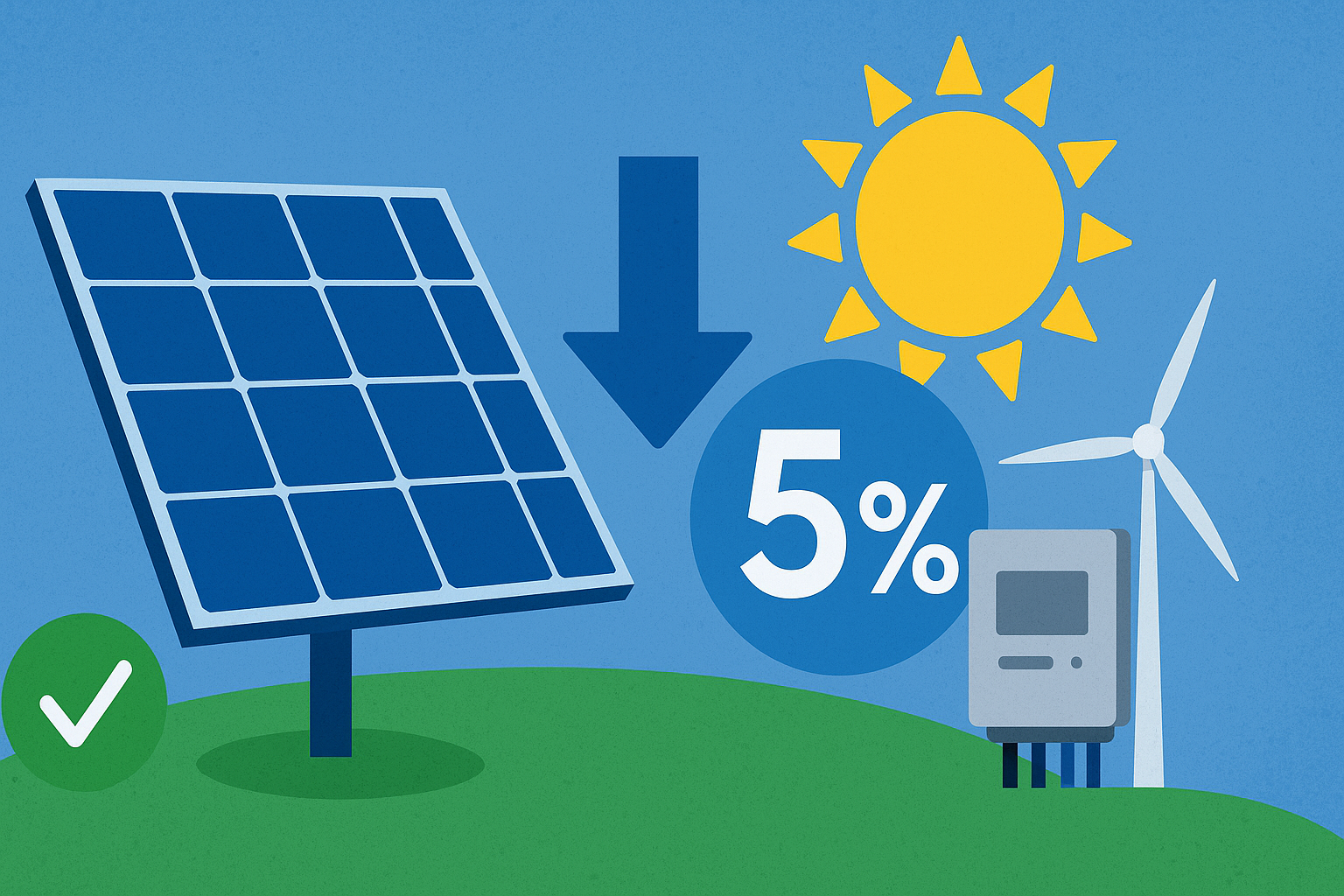

New GST Rules Slash Solar Costs

Renewable Energy AnnouncementPosted by admin on 2025-09-15 12:01:37 |

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 225

Good news for the renewable energy sector! The GST Council has reduced GST on many renewable energy components from 12% to 5%, effective 22 September 2025. This directly impacts solar modules, inverters, BOS items, and equipment used in renewable energy parks.

Quick Summary

- GST on key solar components: 12% → 5% (from 22 Sept 2025)

- Applies to solar cells/modules, inverters, and other specified renewable energy equipment.

- Target impact: Lower EPC cost, cheaper levelized tariff, faster adoption.

- Action needed: Update quotes/POs, check HS codes, and structure EPC contracts smartly.

What Changed

- New GST rate: 5% (earlier 12%).

- Includes cells whether or not assembled into modules.

- New GST rate: 5% (earlier typically 12%).

- Wind, biogas, waste-to-energy, tidal/wave equipment—moved to 5% where specified by notification.

- Services generally remain at 18%. For composite EPC contracts, watch for CBIC clarifications on valuation. Consider separating Supply (Goods @5%) and Services (likely @18%) in contracts to capture the benefit properly.

Effective Date

- 22 September 2025 (Navratri start). Use this date for pricing, invoicing, and contract cutovers.

Rate Snapshot (for Solar Projects)

Item

Hints/Examples

Likely GST after 22 Sept 2025

Solar cells/modules

HSN 8541-series

5%

Solar inverters

HSN 8504-series

5%

Mounting structures, cables, junction boxes, SCADA, transformers (if covered as RE equipment)

As specified in notifications

5% (where notified)

EPC services / design, installation, commissioning

Service portion

18%

O&M / AMC

Service

18%

Search

Categories

Recent News

- Reduction of Cross Subsidies in Karnataka's Electricity Sector

- Economic Benefits of Solar Power Projects

- Karnataka Open Access Rules and Regulations

- eclouds

- Small Hydel Policy 2024

- India’s Renewable Energy Milestones: 2024

- eClouds Eyarthi's AMC on Solar Projects

- Reduction of Cross Subsidies in Karnataka's Electricity Sector